Here at YunoJuno, we want to help you remove the headaches and confusion around all things IR35. We have put this guide together to help you through all those tricky questions about assessments, payments and insurance.

What is IR35?

IR35 is the set of rules about whether or not a contractor is “employed for tax”. This is known generally as their “IR35 status”. This is not the same as being an employee - it’s a set of tax rules determining if the individual’s income-based taxes need to be deducted at source. You’ll also see it referred to as off-payroll working by HMRC. As everyone calls it IR35, we’ll use it in this guide.

The change in the IR35 rules that happened on 6 April 2021 was that legal responsibility for determining IR35 status was transferred from the contractor to the end client.

This 2021 evolution of IR35 represented the most significant shift in the rules that have applied to contractors for some time. It placed a new and effective compliance burden on end clients - not getting it right can be expensive.

Who Does It Affect?

It very clearly affects you as an end-user of a contractor - but all of the parts of the supply chain are relevant to IR35 compliance:

- A contractor who provides their services through a Personal Services Company (you’ll often see these referred to as a “PSC”)

- Anyone that provides a PSC contractor in a supply chain to an end client

- You as the end client if you receive services from a PSC contractor (even if there’s no one in the middle of the supply chain)

As an end client, you must assess each contract when engaging with a PSC contractor.

However, as with all things in life, there are exceptions. These exceptions apply to small businesses in the private sector. The legislation focuses mainly on medium and large-sized end clients in the private sector and any end client in the public sector.

For a small business to qualify as exempt, it must hit two of the following criteria:

- Have fewer than 50 employees

- Gross assets need to be less than £5.1 million

- An annual turnover of less than £10.1 million

We cannot emphasise this enough: it’s your legal obligation to decide if you are a small business and therefore exempt. And remember, it’s the group of companies that counts, and there are particular rules about which financial year is looked at. It’s essential to look at the details here, and HMRC has a help page just on this.

When to do an assessment?

If you think you’re going to engage a contractor caught by the rules because of how they provide their services, then you need to do an assessment to determine their IR35 status.

To do the assessment, you need to think carefully – it has more to do with working practices on the ground than contract terms, but there are several factors that need considering (according to HMRC’s guidance):

Control, personal service, equipment, financial risk, basis of payment, mutuality of obligation, part and parcel of the organisation, right to terminate a contract, length of engagement, intention of the parties, etc.

Make sure you also check out IR35 safe, the assessment tool built by expert tax advisors. It helps you carry out your IR35 compliance tasks on freelancers you book via YunoJuno and locks down your audit trail so you can prove compliance in accordance with the rules.

It’s built with users like you in mind - including letting you set up roles and flow your status assessments through your supply chain with a simple click of a button.

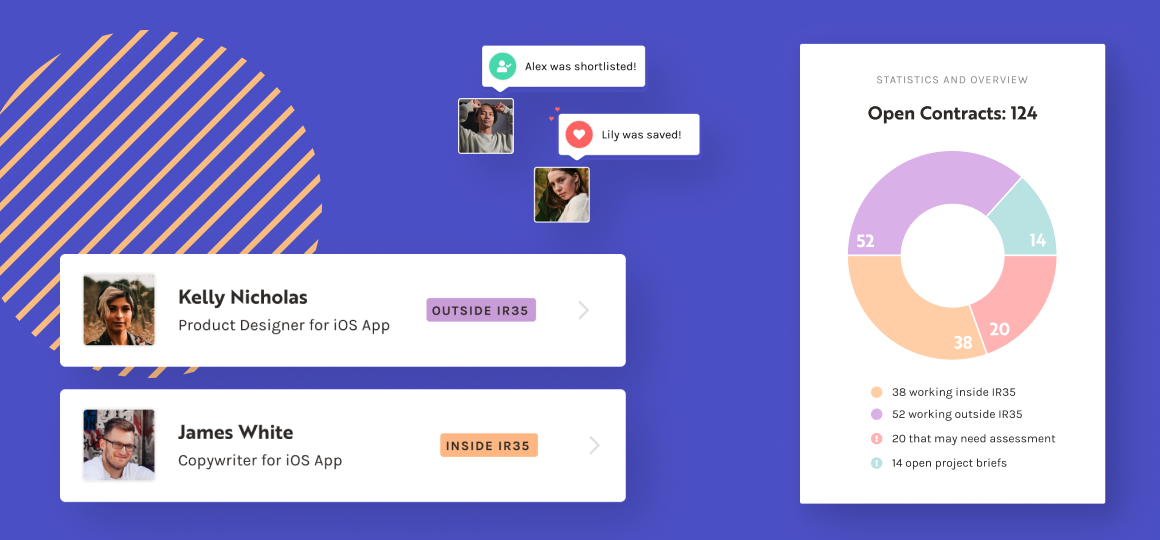

Status assessments tell you whether the contract with the contractor is “Inside IR35” or “Outside IR35” - and you communicate this to the contractor in a document called a “Status Determination Statement”.

What is Inside/Outside?

Inside IR35 = The contractor is an employee for tax purposes, meaning you are a “deemed employer” and must pay taxes on a PAYE basis: you pay your Employer’s National Insurance Contributions and Apprenticeship Levy, and you have an obligation to tax the contractor at source for payments of their Employee’s National Insurance and income tax. (You still pay VAT if their PSC is registered for VAT.)

Outside IR35 = The contractor is not an employee for tax purposes, meaning they can be paid without any deductions. (You still pay VAT if their PSC is registered for VAT.)

What is a Status Determination Statement (SDS)?

An SDS is a document which records the result and reasoning of your IR35 assessment on a contract.

You have an obligation to pass the SDS to the contractor and through the supply chain to the person who is paying the contractor’s PSC (they are called the “fee payer”). On YunoJuno, we ensure freelancers on our platform and all the right people in the supply chain get copies of the SDS.

The critical element is that whatever tool or service you use, you need to take a high level of care to do it properly - if you don’t, there could be consequences with HMRC at a later date. The YunoJuno platform will guide you when you are required to carry out an IR35 assessment on freelancers during the booking process. Still, you may want to do a provisional evaluation for a particular assignment to familiarise yourself with how this works.

- YunoJuno's built-in IR35 Assessment Tool will determine the status of the freelancer.

- HMRC also has their own IR35 assessment tool called CEST (Check Employment Status for Tax)

Managing payments is a minefield

When you have to pay multiple contractors across multiple business structures (PSCs, Sole Traders and Umbrella Companies), you will need a strong process and clear audit trails to show your organisation meets all tax obligations. YunoJuno has grown to be the largest marketplace of elite freelancers in the UK, managing half a billion pounds of freelancer payments. The YunoJuno platform makes the process of handling all your freelancer payments easy and fully compliant.

Managing payments appropriately

If a contract is deemed ‘Inside IR35’, you will be responsible for deducting all appropriate taxes at the source and passing them through to HMRC. It is imperative that you have the right tools and processes in place to make this as seamless as possible and keep your business on the right side of HMRC’s guidelines.

You can manage an inside IR35 payment with a contractor in several ways.

- Put them on your payroll - this creates a lot of internal hassle and adds to the headcount.

- Ask them to go via an Umbrella company - you need to do your due diligence on the umbrella company to ensure they are compliant (and many genuine contractors will not want to do this because it makes their accountancy costs more expensive).

- Work with a compliant partner like YunoJuno, who can ensure all deductions are made and passed to HMRC whilst they still work via their PSC.

It can be a minefield, but you must ensure you have a compliant method for deducting tax at the source and passing it through to HRMC.

What’s the risk?

HMRC can come after the whole supply chain, but they start at the top, with the end client.

HMRC can claim against you for unpaid National Insurance (both yours and the contractors), your unpaid Apprenticeship Levy and - the biggest liability - the contractor’s unpaid income tax.

HMRC will add late payment fines, interest and, depending on the circumstances, penalties.

This means that the final bill for getting it wrong will double the cost and expose the end client to wider compliance scrutiny by HMRC.

Protection for now and in the future

The contracts for Outside IR35 freelancers you book with YunoJuno are protected by specialist IR35 insurance. It is underwritten by Zurich and will stay live if HMRC comes calling at any point in the four years after the end of the assignment by the Outside IR35 freelancer.

The insurance covers:

- £100,000 legal defence cover

- £100,000 taxes, interest and penalties.

IR35 management and protection by experts

IR35 Safe by YunoJuno is the end-to-end IR35 solution created by the UK's largest provider of premium freelance talent. With IR35 Safe, companies can confidently hire freelancers and manage all compliance issues on an easy-to-use platform. Collaborating with tax, legal, finance and human resources experts, IR35 Safe delivers what your organisation needs to stay on the right side of IR35.

If you still have questions about IR35, assessments, payments or insurance, please contact us, and we’ll be happy to guide you to have the right freelance options in place for your organisation.