Independent Contractor Compliance: IR35 and Beyond

Stay compliant with IR35 in the UK while managing worker classification globally. YunoJuno automates assessments, onboarding, contracts, and payments, reducing misclassification risk and admin across every market.

.svg)

.svg)

Confident contractor classification

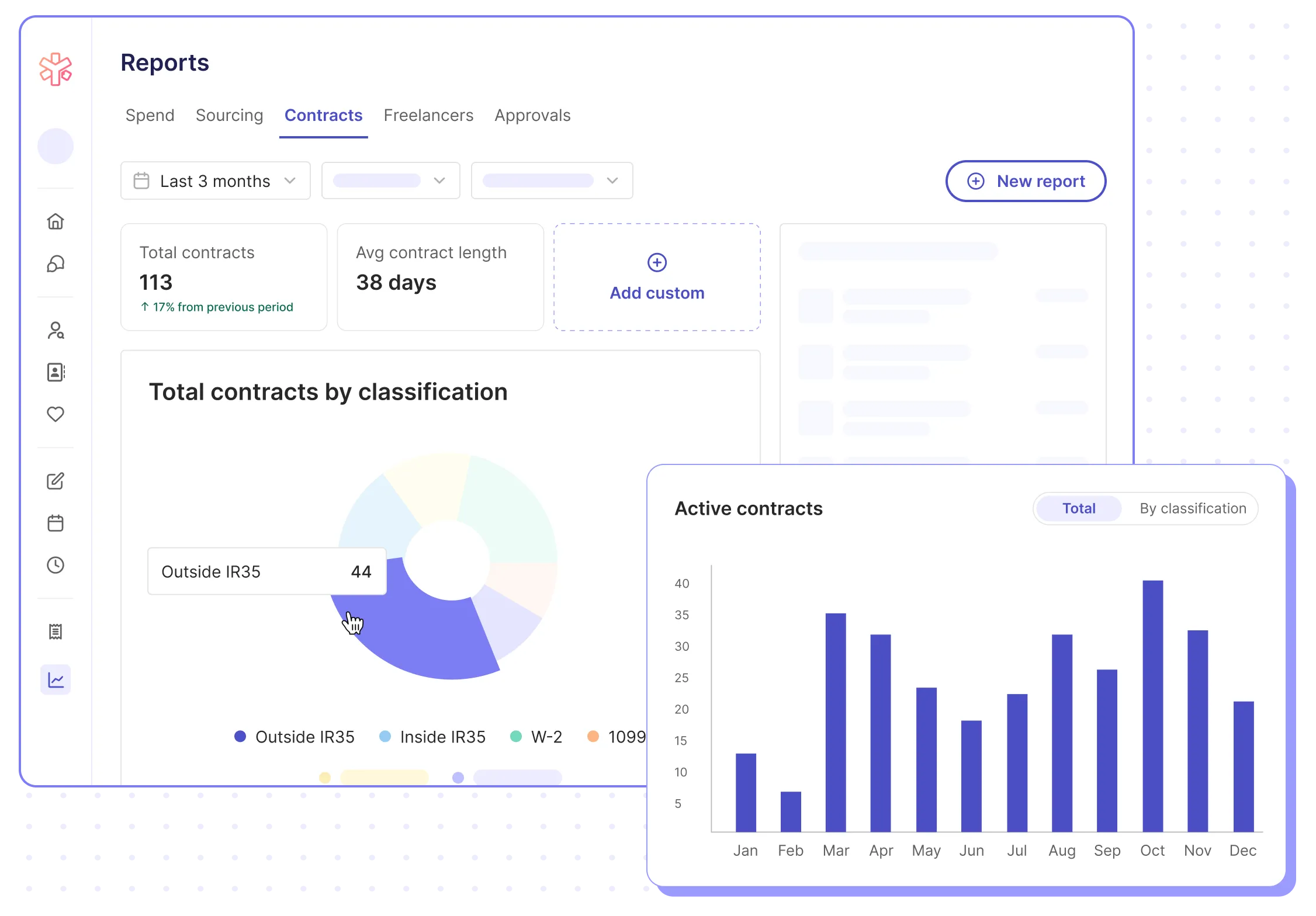

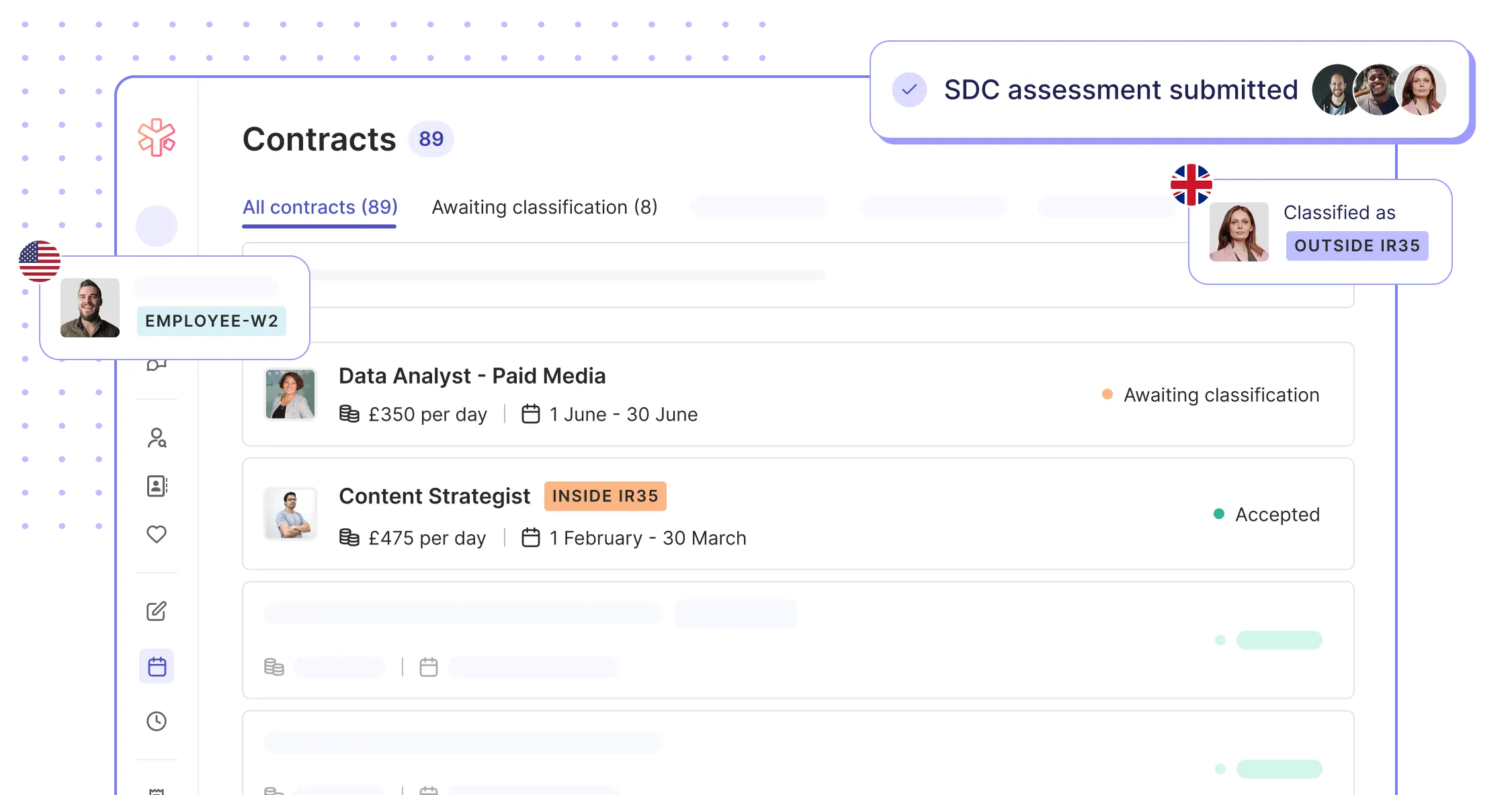

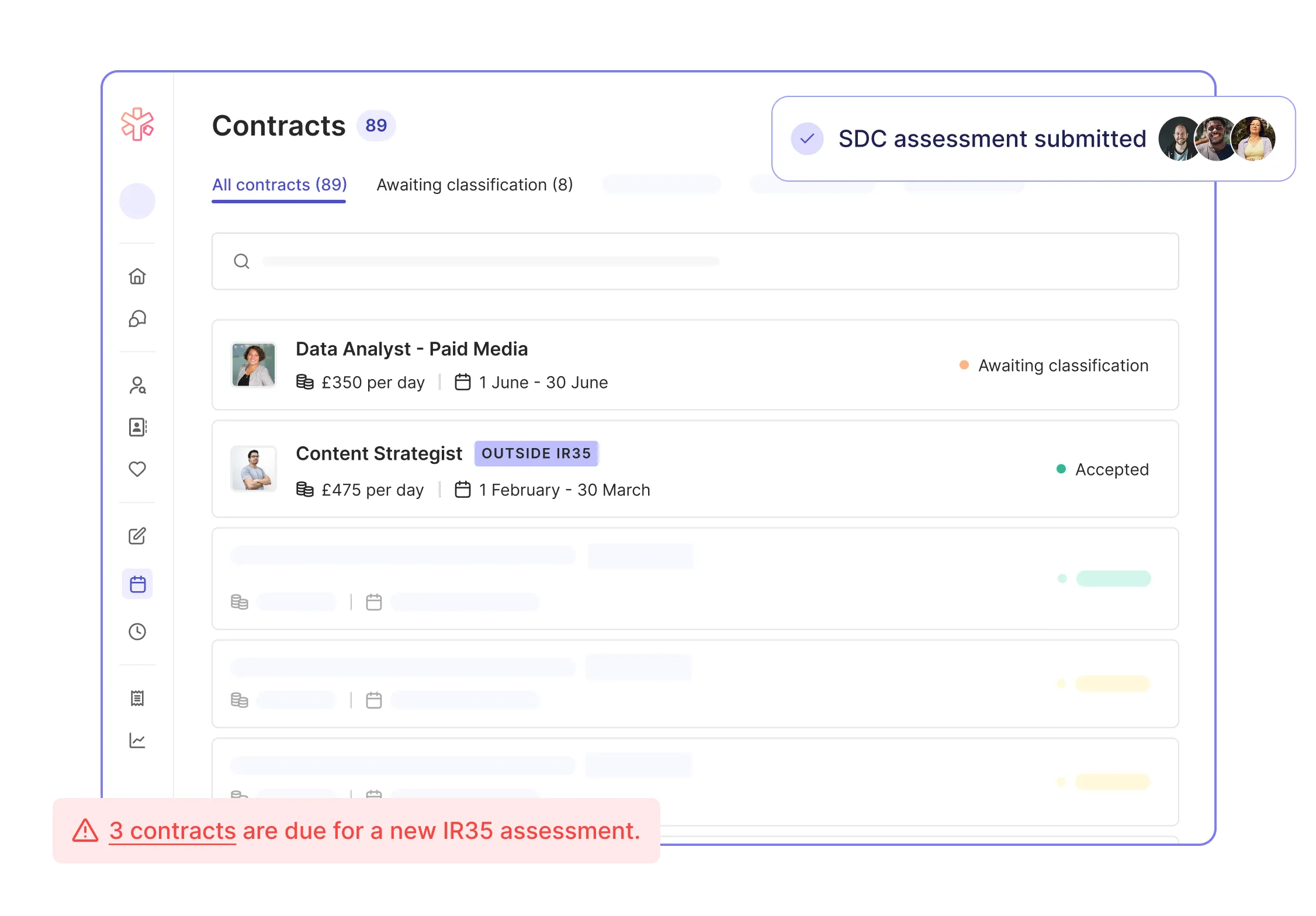

Avoid costly misclassification risks with technology-powered compliance workflows. Whether it’s IR35 in the UK, SDC in Europe, or 1099 vs W-2 in the US, YunoJuno ensures compliance across all regions.

Classify every contractor correctly under local regulations

Access audit-ready records, including IR35 determinations and decision rationale

Stay protected with built-in insurance and indemnity

How YunoJuno compares on contractor compliance

Choosing the right compliance solution is critical to protecting your business. YunoJuno goes beyond single-jurisdiction tools like CEST or outsourced determination providers by offering an integrated, global approach. Whether it is IR35 assessments in the UK, SDC in Europe, or 1099 vs W-2 in the US, YunoJuno delivers one platform that automates worker classification, manages payments, and provides full audit trails with insurance-backed protection. The table below shows how YunoJuno compares to traditional approaches, giving enterprises a complete, scalable compliance solution.

The UKs No.1 IR35 solution

Contractor payments

Inside or outside IR35?

Comprehensive insurance coverage on all IR35 bookings

Reducing time to hire

Reducing admin

Explore our compliance resources

Access guides, FAQs, and tools to simplify contractor compliance. From IR35 in the UK to worker classification worldwide, explore resources designed to keep your business protected and informed.

FAQs

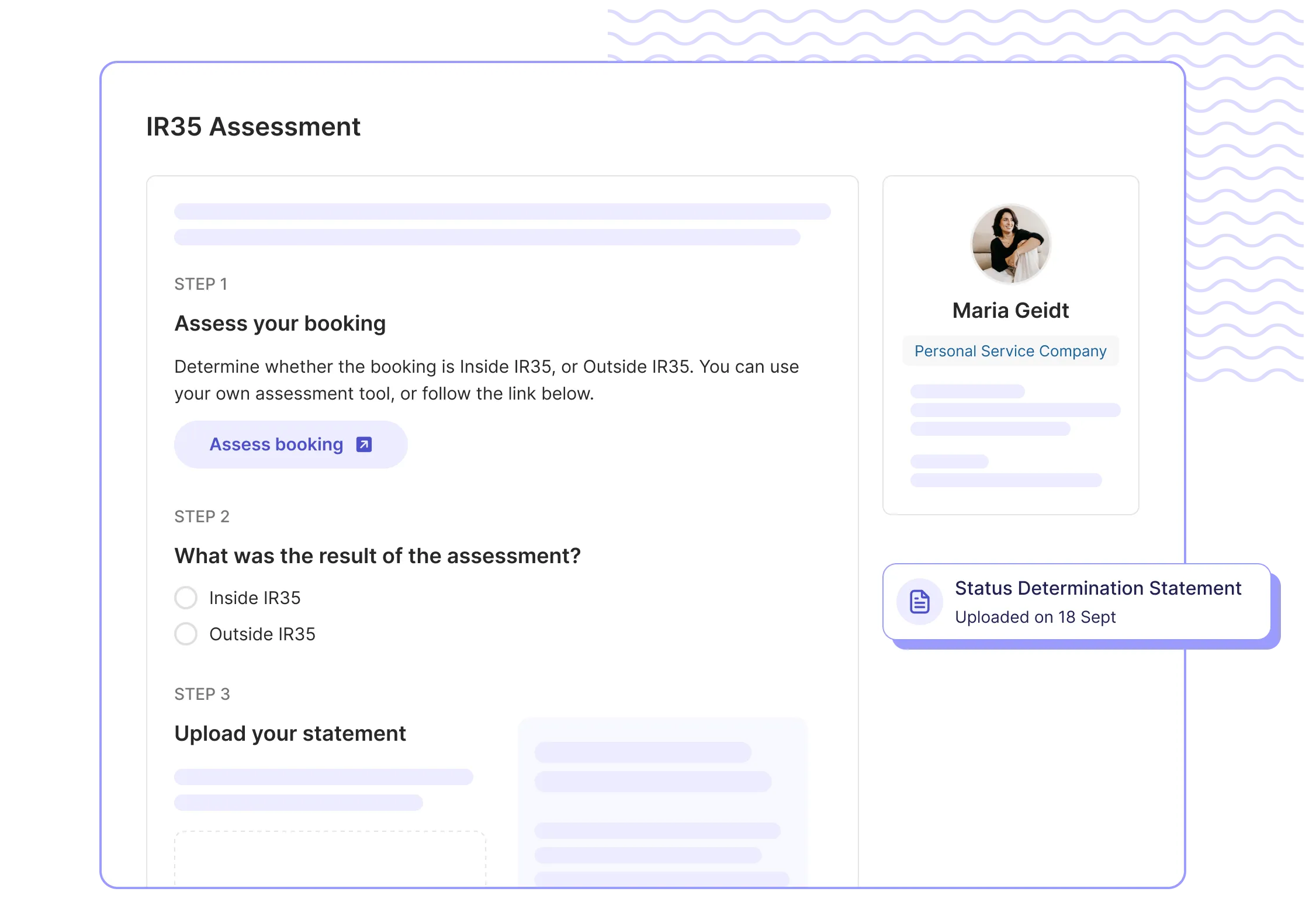

IR35, also known as the off-payroll working rules, is a UK tax legislation designed to spot contractors and businesses who are avoiding paying the appropriate tax. They do this by working as ‘disguised’ employees, or engaging workers on a self-employed basis to hide their real employment status.

IR35 rules apply if a freelancer provides services to a client through an intermediary, usually their own company e.g. a Personal Service Company (you may know this as a Limited Company) They would be classed as an employee for tax purposes if they were contracted directly.

If the rules apply and a freelancer is considered to be inside IR35, tax and National Insurance contributions have to be deducted and paid to HMRC.

If your freelancer works inside IR35, you’ll need to tax the freelancer at source, deducting income tax and national insurance, as well as employer's NICs.

If the freelancer works outside of IR35, your business must pay the freelancer the whole amount, without deducting PAYE and NIC.

Contractor misclassification occurs when a worker is incorrectly engaged as an independent contractor rather than as an employee. This creates financial, tax, and legal risks for businesses. In the UK this is governed by IR35, while in the US it often relates to 1099 vs W-2 determinations. YunoJuno helps you stay compliant across multiple jurisdictions with verified frameworks and audit-ready workflows.

IR35 is the UK’s off-payroll working legislation, designed to ensure contractors working like employees pay the correct tax. YunoJuno automates IR35 determinations as part of its global compliance system. This means you can manage IR35 in the UK alongside other international requirements, like SDC in Europe or US worker classification, all in one platform.

No. YunoJuno gives contractors and clients the freedom to engage through their preferred model, whether that’s a personal service company (PSC), sole trader, PAYE, or umbrella. Our workflows handle the tax deductions and reporting required in each case, so you stay compliant without forcing contractors into one route.

Yes. YunoJuno provides insurance and indemnity to protect businesses against legal fees, tax liabilities, and penalties related to misclassification risks. In the UK, this includes coverage for IR35 contracts, and globally it extends to equivalent contractor compliance frameworks.

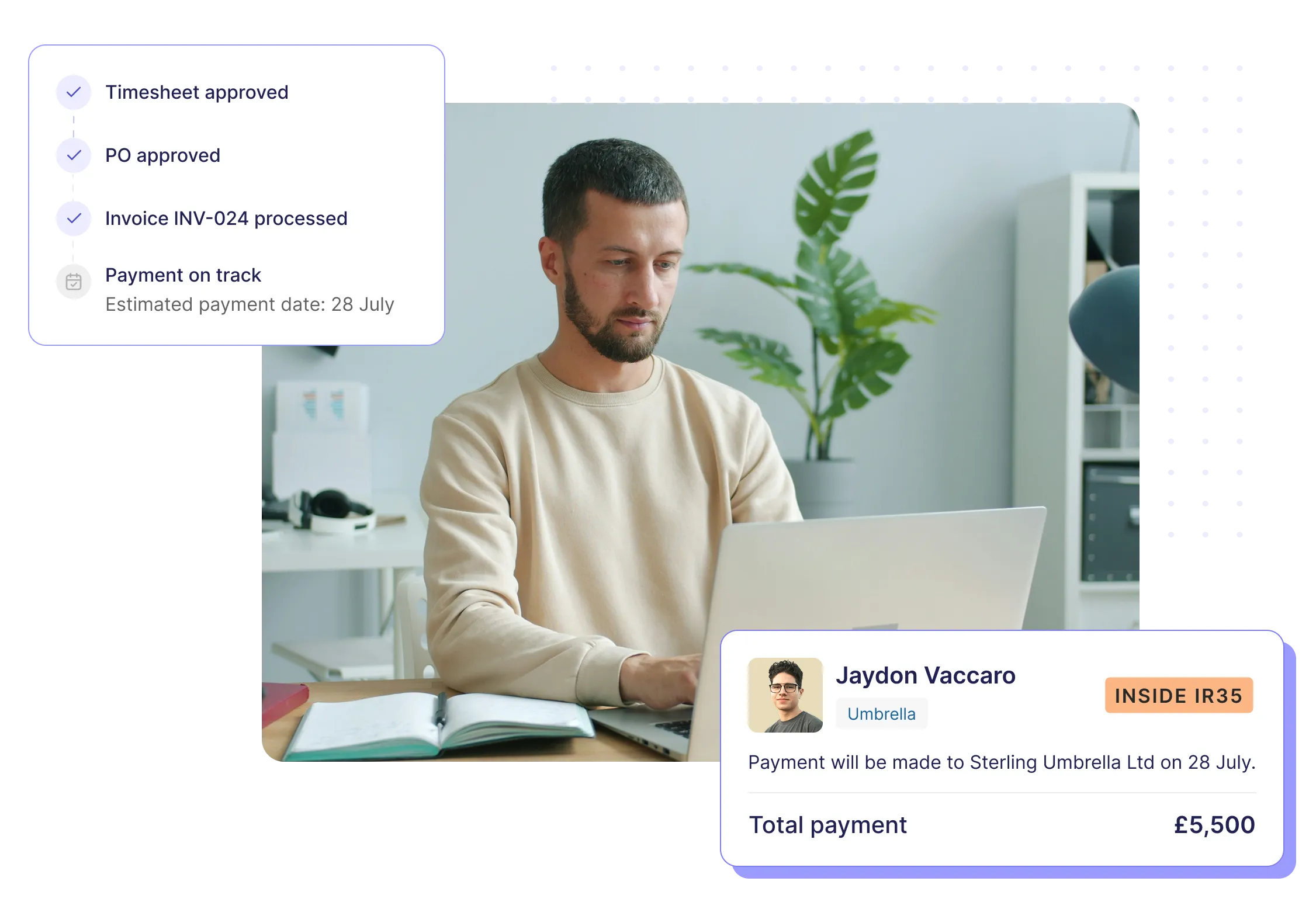

Payments are guaranteed on time through YunoJuno’s integrated payments infrastructure. Where tax deductions are required, such as for inside-IR35 contracts in the UK or W-2 arrangements in the US, YunoJuno manages them automatically. This removes admin for finance teams and ensures contractors are paid correctly every time.

Yes. YunoJuno allows you to onboard and manage your own contractor network alongside talent sourced via agencies or our curated marketplace. All classification, documentation, and payments are centralised, giving you visibility and compliance oversight in one system.

No, YunoJuno is not an umbrella company. YunoJuno is a freelance management platform that brings freelancers and clients together regardless of how their business is set up.

If a freelancer chooses to structure themselves via an Umbrella Company, then in order to find assignments with clients on YunoJuno they must be with an FCSA approved Umbrella company.

Manage your global contractor workforce with confidence

From sourcing to payments, manage your contingent workforce with automation, compliance, and real-time visibility built in.

Are you a freelancer? Join YunoJuno

%202025%20-%20PEAK%20Matrix%20Award%20Logo%20-%20Leader.webp)